One Model. One Truth.

One Source for the Whole Company!

Long-tail liability insurers rely on many sources of data and analysis to manage and

assess risks.

ICRFS™ introduces a new standard in long-tail risk management

— delivering a unified,

enterprise-wide perspective.

A Unified, Data-Driven Risk Model

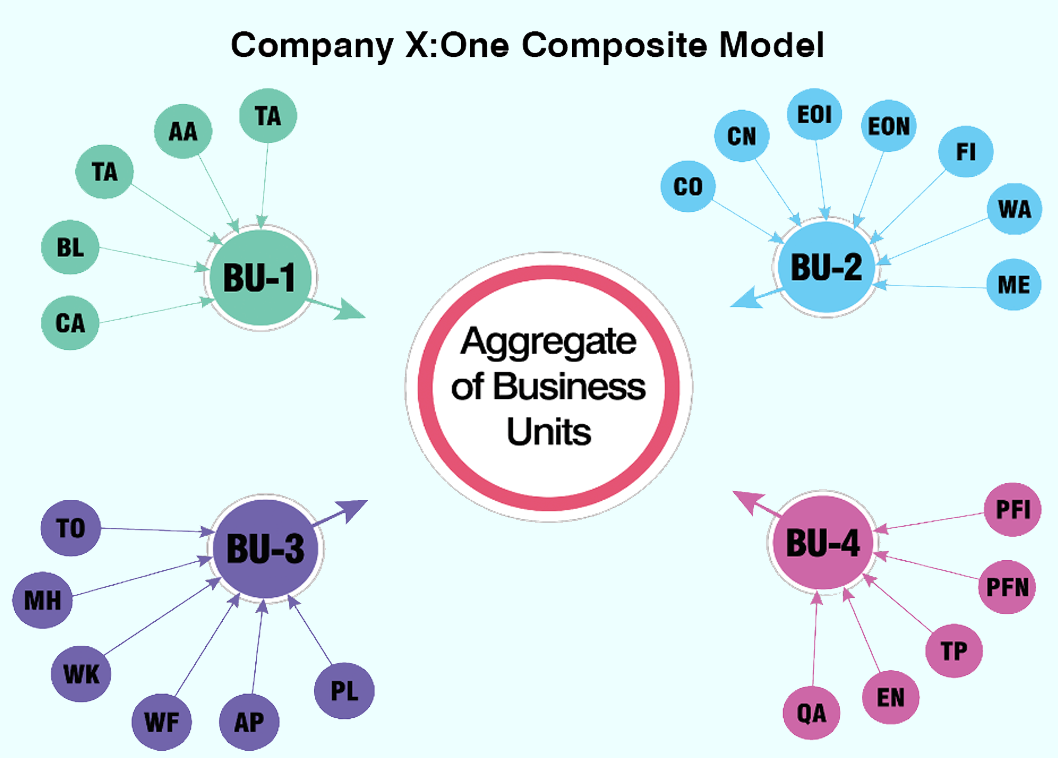

Our Multiple Probabilistic Trend Family (MPTF) modelling framework identifies

a

single, optimal composite model across multiple lines of business

and segments.

The model is driven by the data, with future forecast assumptions made explicit and

auditable.

ICRFS™ explicitly measures and connects:

- Social inflation

- Impact of law reform

- Process volatility

- Trend relationships between Case Reserve Estimates and Paid Losses

- Emerging risks as they develop

- Common drivers across lines

- Volatility correlations between businesses and segments

The above, with the accompanying forecast distribution metrics, enables a genuinely enterprise-wide understanding of risk behaviour.

A Single Point of Reference for the Enterprise

ICRFS™ establishes a single, consistent point of reference for risk metrics across all lines of business, segments, and business units.

Rather than managing disconnected spreadsheets and competing views, decision-makers assess social inflation, volatility, correlations, and assumptions within one coherent framework — ensuring alignment across actuarial, risk, and executive functions.

Built for Decision-Makers and the Actuaries

Who Support Them

ICRFS™ empowers senior management to:

- Interactively explore and interrogate risk characteristics

- Run what-if scenarios and sensitivity analyses in real time

- Understand the implications of emerging trends before they materialise

For actuaries: trends, volatility and volatility correlations are measured from the data – and future assumptions can be directly connected to historical experience.

For executives: risk capital decisions are supported by a transparent, company-wide model that reflects the true risk profile of each portfolio.

Modelling wizard for individual lines

A modelling wizard, optimisation algorithms, and comprehensive statistical diagnostics are used to rapidly identify the optimal, parsimonious model.

The model on a log scale is summarized by four charts:

- Development period trends;

- Accident period trends

- Calendar period trends

- Process volatility

- The impact of emerging risks in real time